Best Savings Accounts in Singapore 2020

Do you know the interest you are getting from your savings account? Ever wonder how you earn interest on a savings account?

Believe it or not, most Singaporeans are still using a POSB savings account with the standard POSB interest rates of 0.05% p.a. But why do you earn interest on a savings account?

Here is how it works. When you deposit money into a savings account, it isn’t just tucked away into a safe, like if you were to store your money at home. Banks use the money that is trusted to them for a variety of things, primarily to loan out money to borrowers. They charge the borrower interest on those loans and give part of that amount back to you, in the form of interest earned on your savings account.

Curious about how you can take better advantage of what all the banks have to offer and look for a savings account with higher interest rates? To save you time, we’ve done some of the research and here is our pick of the best savings accounts in Singapore with the best interest rates for 2020.

Scroll on to see our picks!

#1 For Average Consumers, Highest Effective Interest Rate & Foreign Transactions:

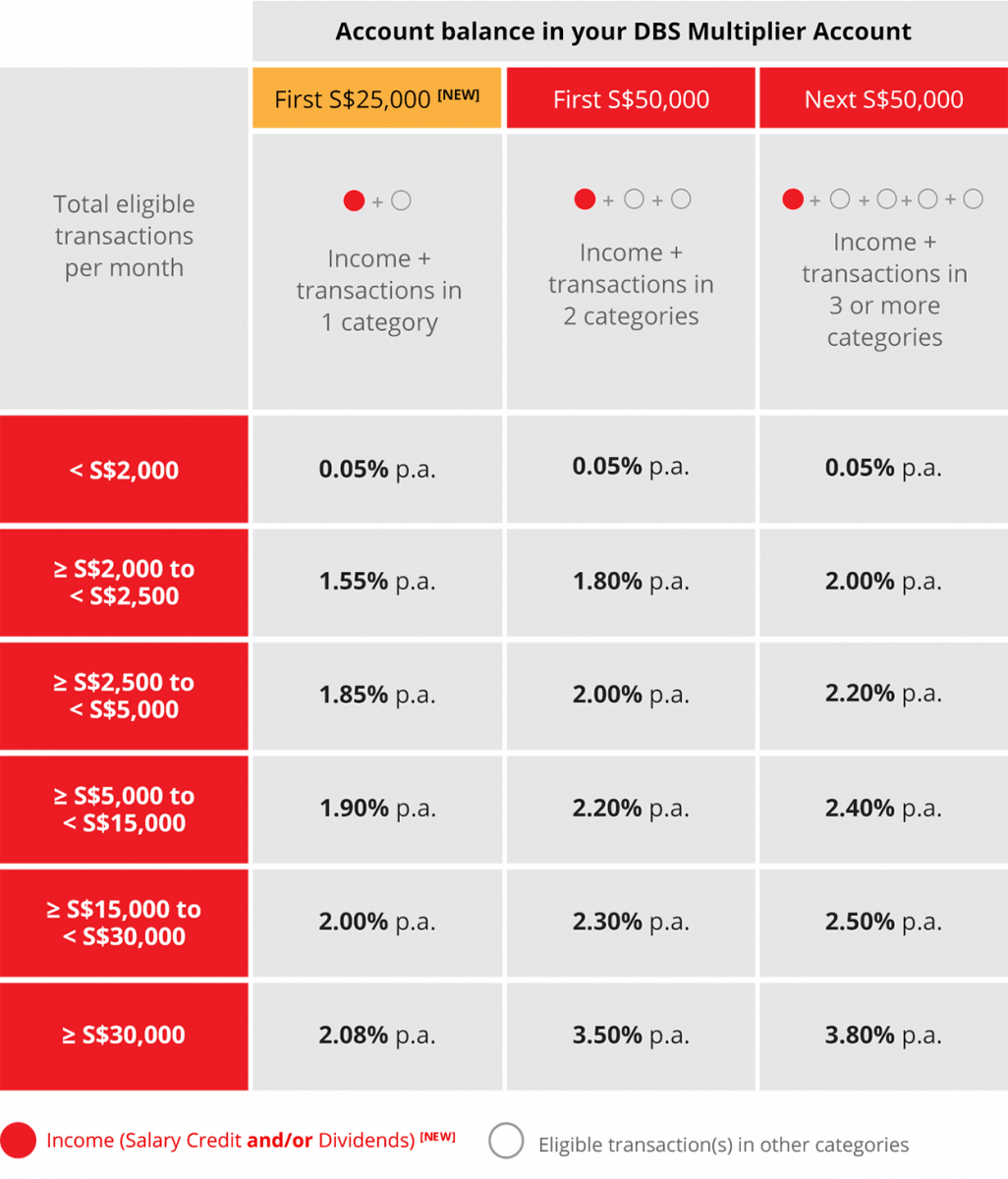

DBS Multiplier Account

Photo from DBS

Photo from DBS

Key Features

- Get up to 3.8% p.a. interest

- No minimum salary credit and no minimum credit card spend

- Credit your salary and transact in more than 1 of the following categories: credit card spend, home loan instalment, insurance, and investments

Photo from GirlStyle Singapore

Photo from GirlStyle Singapore

Transact in more categories and increase your monthly eligible transaction amount to earn higher interest rates.

DBS Multiplier interest rates (for first S$25,000):

Income credit [compulsory] + credit card spend: 1.55% to 1.9% p.a.

Income credit [compulsory] + credit card spend + investment/home loan: 1.8% to 2.2% p.a.

DBS

Important notice:

Revision of DBS Multiplier interest rates for Income + transactions in 1 category w.e.f. 1 May 2020.

Find out more here.

#2 For Average Consumers, Highest Effective Interest Rate:

Standard Chartered Bonus$aver Account

Photo from Standard Chartered

Photo from Standard Chartered

Key Features

- Interest of up to 3.88% p.a. on your first S$100,000 eligible deposit balances

- Insured up to S$75k by SDIC (Singapore Deposit Insurance Corporation)

Photo from GirlStyle Singapore

Photo from GirlStyle Singapore

Standard Chartered interest rates:

S$3,000 salary credit: 1.1% p.a.

S$3,000 salary credit + S$500 credit card spending: 1.6% p.a.

S$3,000 salary credit + S$500 credit card spending + pay 3 bills by GIRO (min. $50): 1.7% p.a.

Photo from Standard Chartered

Photo from Standard Chartered

Important notice:

Revision of Bonus$aver w.e.f. 1 Apr 2020.

Find out more here.

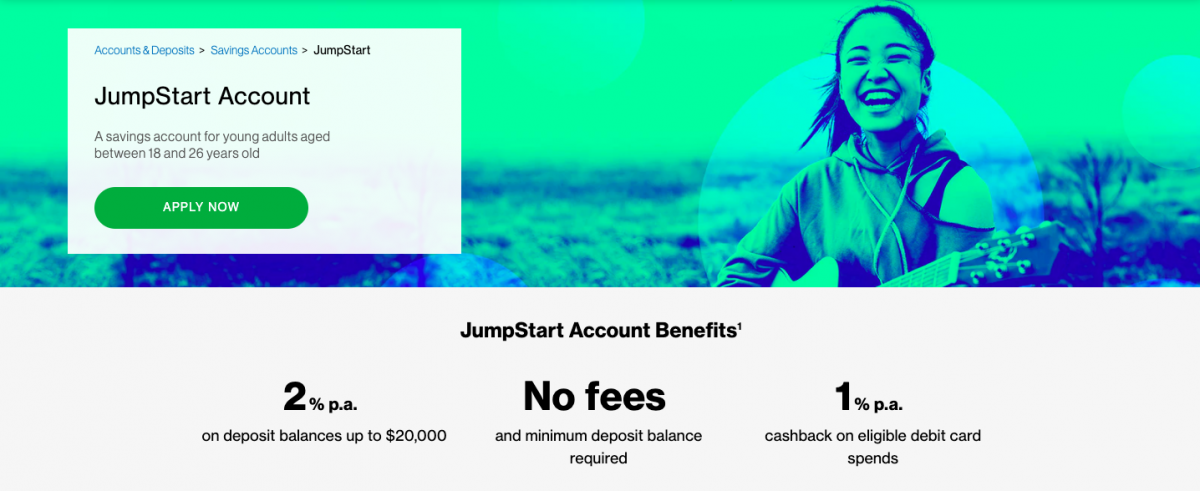

#3 For Young Adults Between 18-26 Years Old:

Standard Chartered JumpStart Account

Photo from Standard Chartered

Photo from Standard Chartered

Key Features

- Interest of 2% p.a. on up to S$20,000 of savings

- No salary crediting, card spend, or any other requirement needed, aside from being 18 to 26 years old at the time of account opening

- Debit card with 1% Cashback

- No fees

Photo from GirlStyle Singapore

Photo from GirlStyle Singapore

#4 For Average Consumers, Highest Earnings for Incremental Savers:

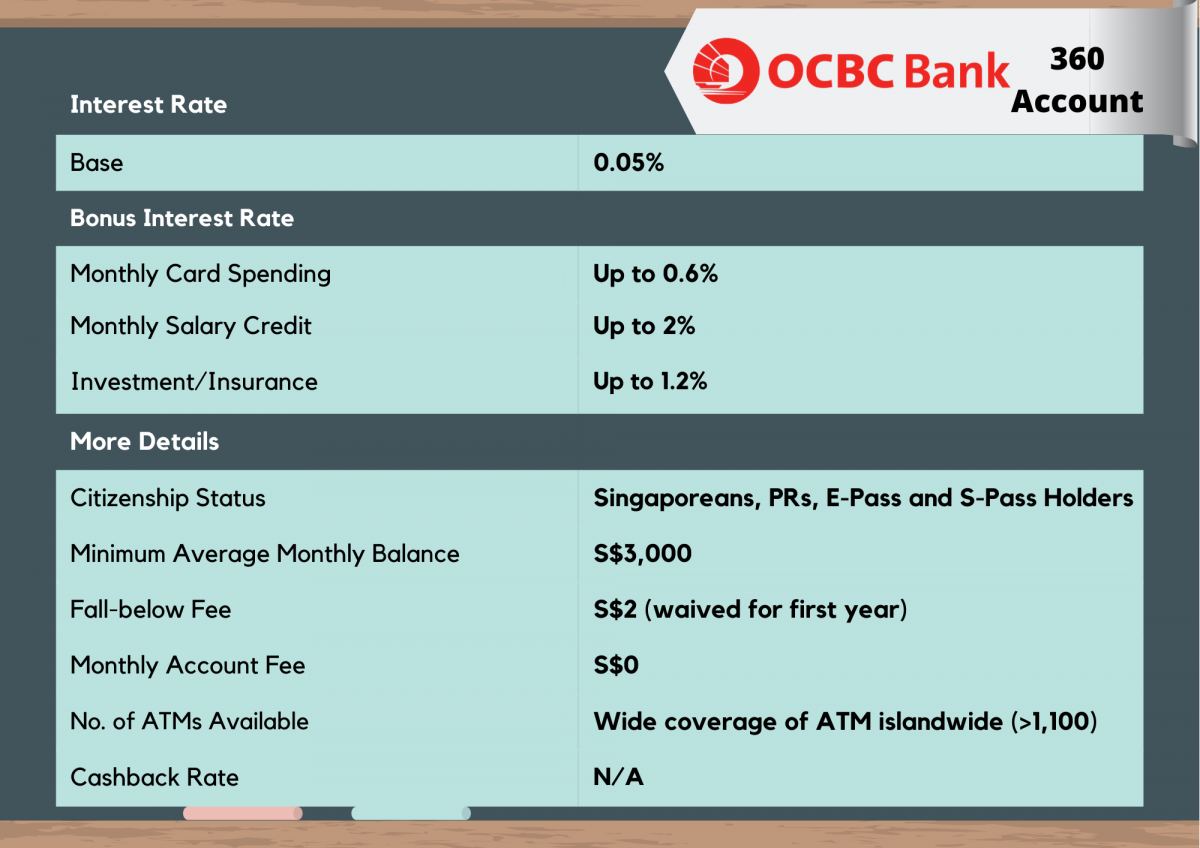

OCBC 360 Account

Photo from OCBC

Photo from OCBC

Key Features

- Get up to 3.45% p.a. bonus interest on your first S$70,000 of savings

- Great bonus rates

- Easy application process

Photo from GirlStyle Singapore

Photo from GirlStyle Singapore

Photo from OCBC

Photo from OCBC

OCBC 360 interest rates (for first SS$35,000):

S$2,000 salary credit + S$500 credit card spend: 1.55% p.a.

S$2,000 salary credit + S$500 credit card spend + increase monthly balance: 1.85% p.a.

S$2,000 salary credit + S$500 credit card spend + increase monthly balance + investment: 2.45% p.a.

If you deposit more than $35,000 in cash, then you get to enjoy a higher interest rate. This is because of its tiered interest system, which benefits people who deposit large amounts of cash.

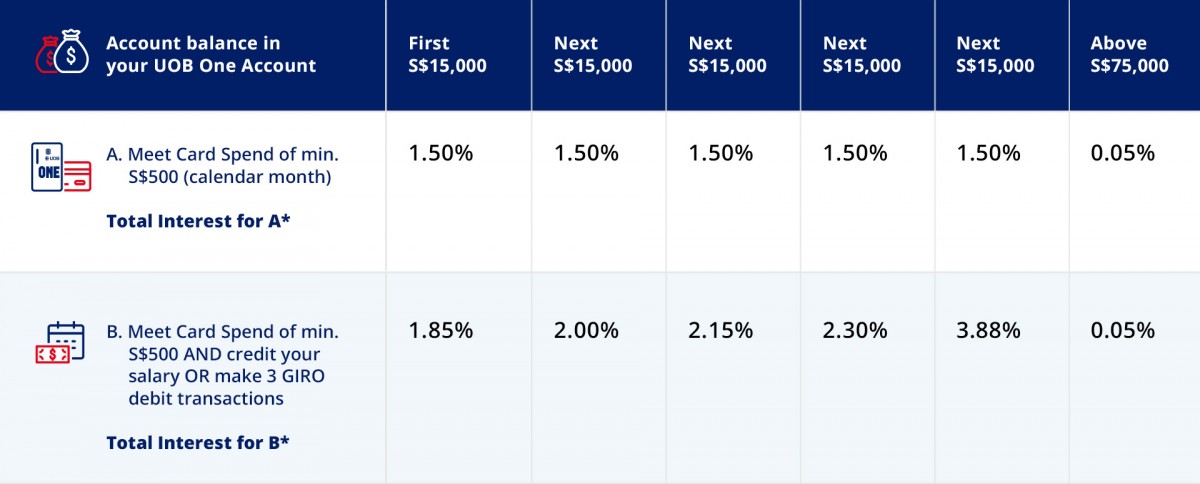

#5 For Average Consumers, Easy–to–Access Top Rates:

UOB One Savings Account

Photo from UOB

Photo from UOB

Key Features

- Up to 3.88% p.a. interest rates

- Up to S$200 cash credit when you sign up online and sign up for a UOB credit card.

- Low initial deposit of S$500

- Withdraw cash conveniently without an ATM card using Mobile Banking

- UOB Young Professionals Solution is a combination of UOB One Account, UOB YOLO and the unique Sweep feature that allows you to automatically invest your earned account interests and card rebate into a Unit Trust

Photo from GirlStyle Singapore

Photo from GirlStyle Singapore

Photo from UOB

Photo from UOB

UOB One interest rates:

S$500 credit card spend [compulsory]: 1.5% p.a.

S$500 credit card spend [compulsory] + S$2,000 salary credit: 1.85% p.a.

S$500 credit card spend [compulsory] + pay 3 bills by GIRO: 1.85% p.a.

Important notice:

With effect from 1 May 2020, UOB will be revising the interest rates on the UOB One Account.

Find out more here.

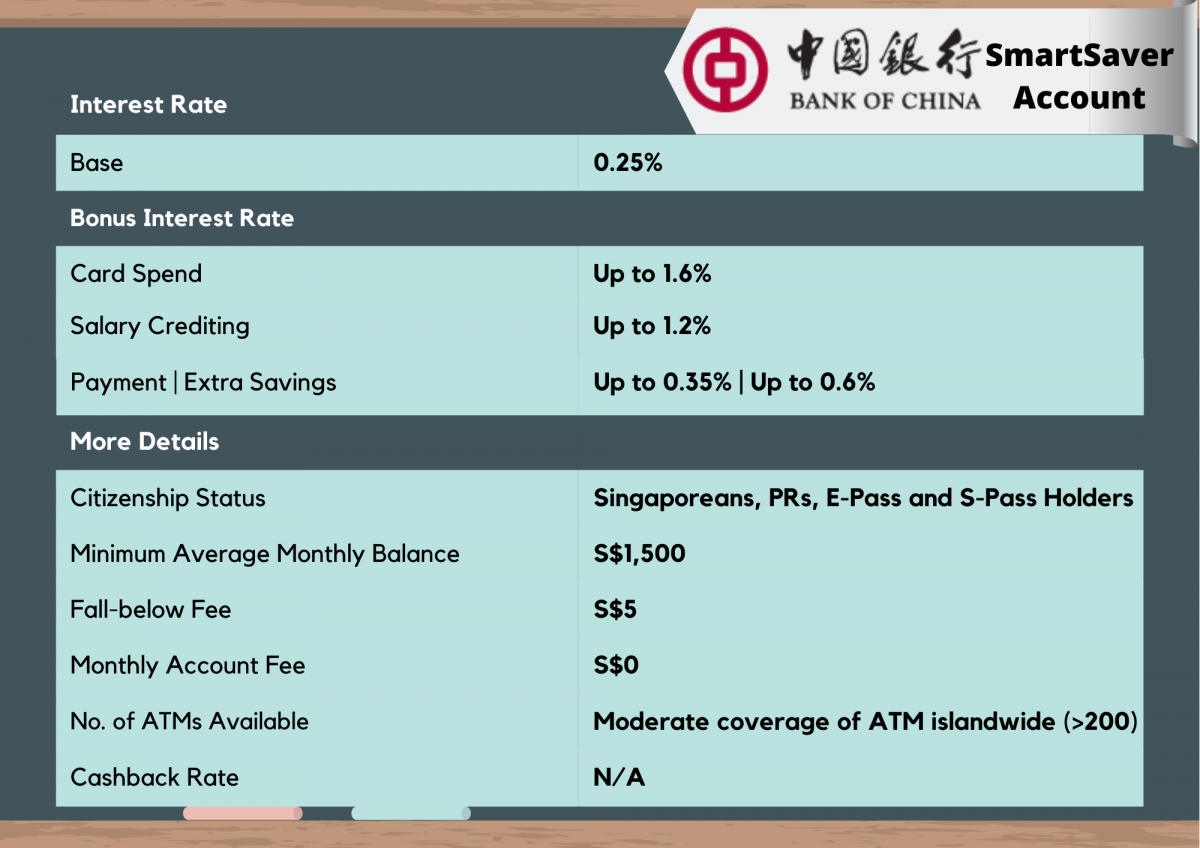

#6 For Wealthy Consumer:

Bank Of China SmartSaver

Photo from Bank of China

Photo from Bank of China

Key Features

- High bonus interest for salary credit

- High bonus interest for credit card spend

Photo from GirlStyle Singapore

Photo from GirlStyle Singapore

Photo from Bank of China

Photo from Bank of China

BOC SmartSaver interest rates:

S$6,000 salary credit: 1.45% p.a.

S$6,000 salary credit + S$500 credit card spend: 2.25% p.a.

S$6,000 salary credit + S$1,500 credit card spend: 3.05% p.a.

S$6,000 salary credit + S$1,500 credit card spend + pay 3 bills by GIRO (min. $30): 3.4% p.a.

#7 For Simple & Easy Savings Accounts in Singapore, Best Low-Risk, Low-Maintenance Account (Beginners):

CIMB StarSaver (Savings) Account

Photo from CIMB

Photo from CIMB

Key Features

- 0.8% on entire account balance

- No multiple conditions or fall-below fees

Photo from GirlStyle Singapore

Photo from GirlStyle Singapore

Dislike monthly interest? StarSaver will give you daily interest instead! By maintaining a minimum of S$1,000 on any given day, you get to enjoy 0.8% p.a. on the entire account. Top up a min. of S$500 each month +0.2%.

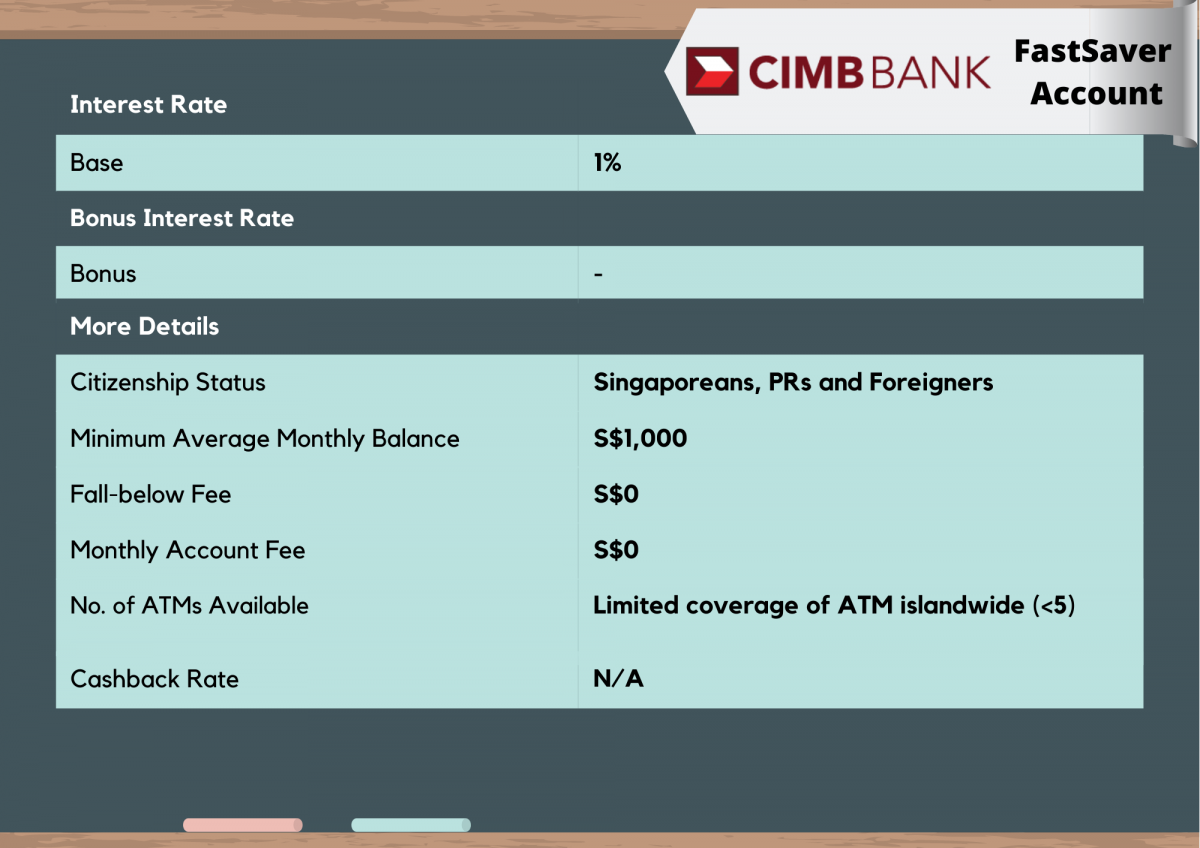

#8 For Simple & Easy Savings Accounts in Singapore, Highest Base Interest Rates:

CIMB FastSaver Account

Photo from CIMB

Photo from CIMB

Key Features

- Maintain a minimum deposit of S$1,000 to enjoy an interest rate of up to 1.80% p.a.

- No multiple conditions or fall-below fees

Photo from CIMB

Photo from CIMB

CIMB FastSaver interest rate:

1% p.a. on first $50,000 / 1.5% p.a. on $50,001 to $75,000

Still unsure of which savings account to choose? Try Seedly Savings Account Calculator which you can use for FREE!

Simply fill up some basic information like your - bank balance, monthly salary credited, monthly credit card spend and the calculator will tell you which savings account gives you the highest interest rate!

Share this post with a spendthrift friend and check out our money saving challenges! ?

Text by: GirlStyle SG